Introduction

We designed the Embedded Finance Handbook to help companies in all categories understand how they can use embedded finance technology.

Whether you're in the C-suite looking for ways to innovate and drive new revenue, a Director of Marketing focused on a loyalty program, a Product Manager looking to improve customer experiences, or you just simply want to learn about embedded finance technology, this handbook is for you.

Below, you'll learn about how we got to this pivotal time in financial services, the core financial products and services used in embedded finance, examples of how these products and services can be woven into your existing core business, how to go to market with a new program, and what outcomes you’ll see.

We hope you enjoy the insight below and make sure to contact us with any questions you may have.

How Did We Get Here?

For centuries, banks and major financial institutions have controlled the movement of all money within our society. If you wanted to open up a bank account, wire funds, or make bigger strides like buying a house, traditional financial institutions were the only option.

When the financial collapse of 2008 happened, the world realized that having only one sole source of monetary circulation was its Achilles’ heel. Not only has public trust in banks deteriorated since then, but the internet was in the midst of a giant transformation, and was about to change how the world solves its financial problems in innumerable ways.

"Banking is necessary, banks are not."

Bill Gates

The Shift To Go Digital

Fast forward to today, internet technology has transformed just about every aspect of life – and the financial industry is no different. The collective psychology around how we use apps to manage money has changed, and younger generations are growing up with

completely different viewpoints surrounding banks.

They move money through Venmo, use digital banks like Chime to get quicker access to their paychecks, preload money into their Starbucks account for coffee, and pay for taxis through an app. As the new generations grow into high-earning adults, they are showing an openness to new financial relationships with companies that can help them succeed – regardless of whether that company is a traditional bank or not.

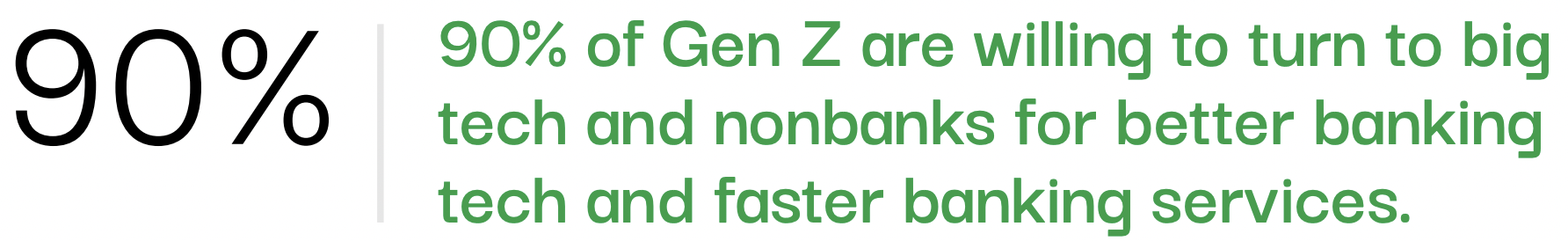

With this in mind, it’s not hard to see how modernized financial processes and technology will be in high demand for this generation. Thus, the first question to ask is who will these customers decide to bank with?

Banking On Your Brand

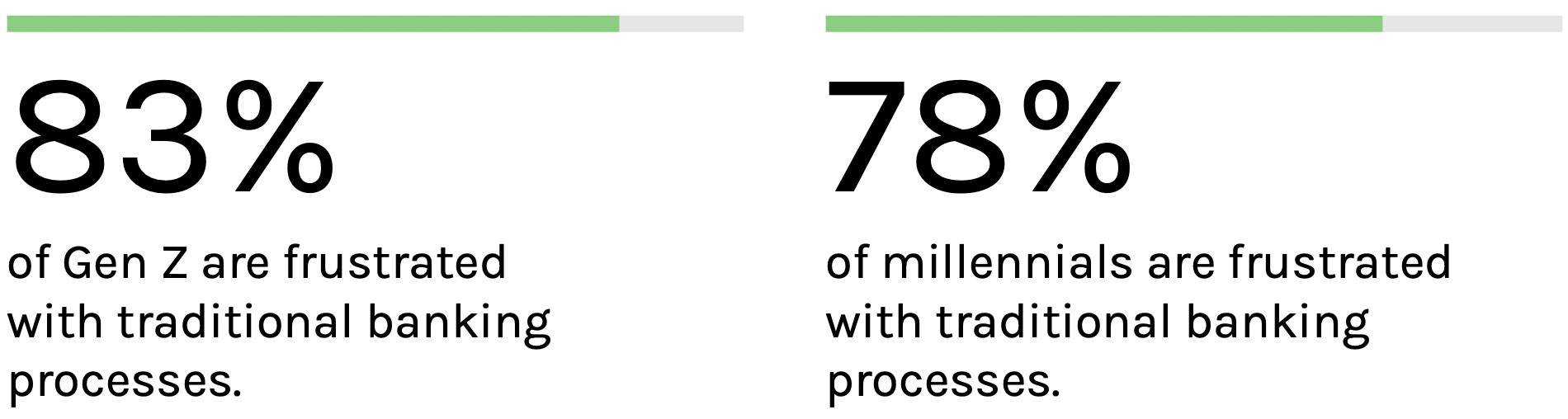

Not only are younger generations frustrated with the old paradigm, but they also expect more from their banking providers. The bare minimum is no longer acceptable, and the numbers prove it.

57% of young banking customers report it’s incredibly important that their bank helps them improve their financial wellness.

So what does this mean for the future of finance? With banking considered to be an industry with the biggest risk of disruption among the younger generation, better banking experiences, and faster financial services are becoming a priority. These consumer needs have paved the way for digital-first banks (Neobanks) and non-traditional banking institutions to offer financial solutions that more closely match consumers' preferences.

As more of the world's top brands like Walgreens, Dollar General, T-Mobile, Starbucks, and Walmart (to name a few) start to offer their customers financial services, the shift in consumer habits is becoming more grounded in utilizing their favorite brands to bank with instead.

Brands and Financial Services - Old Friends

Offering financial services isn’t a new concept for a lot of companies or their customers. Before embedded finance, however, financial services were detached from the brand, creating fragmented less-than-ideal customer experiences.

Think about buying a car - the entire experience of picking out the car, test driving it, and agreeing on the price is with the dealer. But once it comes time for financing and insurance, you're making calls to your insurance provider and an external loan provider which adds hours of painful phone calls and paperwork.

Bad customer experience...

Now, embedded finance changes this. Instead of being detached, financial service products are embedded directly into the brand and become an extension of their core offering. Now, taking advantage of the same financial services feels seamless and built into the customer experience.

Whether it’s Tesla offering insurance at the point of purchasing a new car, Uber allowing you to store a card and pay seamlessly for your ride, or Starbucks allowing you to store money in their app for your coffee, customers have become comfortable with the idea of using financial services from brands in return for better customer experiences.

Trust In Alternative Financial Technologies

Financial technology creates new and improved ways of moving money, paying for things, getting access to different financial products, and more. Ease of use and enhanced customer experiences made financial technology extremely appealing to consumers, and the adoption of this technology made moving money and paying for things online accelerate during the pandemic.

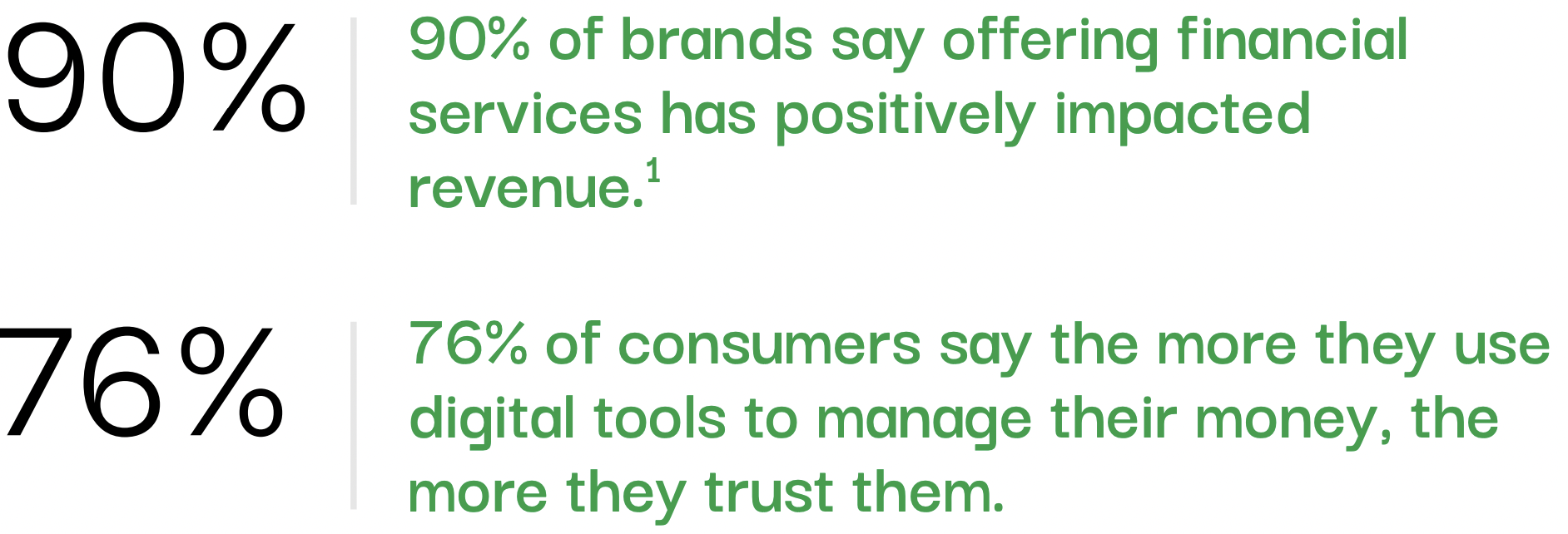

Today, we find ourselves using fintech more often than direct interaction with our primary banks. In fact, many of the financial services we trust the most are offered to us by the brands we interact with most. This all comes back to the fact that brands can use financial technology to deliver exceptional experiences to their customers in ways that banks could never do.

64% of consumers would be likely to use financial services from brands that offered personalized rewards and better customer experiences.

Alviere & Qualtrics consumer survey, Spring 2022.

As brands continue to deliver high-value experiences, consumer trust continues to soar. Interestingly, 60% of 18–36-year-olds trust brands to handle their money, and 73% of millennials would prefer to handle their financial needs through brands like Google, Amazon, Apple, or PayPal.

The Embedded Finance Advantage

We touched above on the fact that financial services and brands are old friends, but the fundamentals behind the detached relationship between the two made clunky customer experiences and inefficient offerings.

This all changes with embedded financial technologies. Embedded finance allows brands and businesses to offer financial services directly to their customers. Through an API, brands can embed financial services into their existing apps, websites, and platforms to provide financial services at the point where they are needed in the customer journey.

In addition to the products themselves, top embedded finance technology companies (like Alviere) provide end-to-end risk and compliance programs that ensure brands that use these tools are in compliance with financial regulations around the world.

When you break down the advantages of using embedded financial technology, you can categorize them into four main buckets - customer experiences, retention, revenue, and data. Let's look a bit deeper.

Customization & Retention

The best instances of embedded finance are invisible, or so built into the customer experience that it becomes secondary to the customer's objective.

An example of this is how Uber built payments into the ride-hailing experience. Paying for your ride is secondary to getting connected to a driver and knowing when you'll arrive at your destination.

The flexibility of embedded finance APIs lets brands choose when and where to place a particular product or service in their customer workflows. This ability to customize is something that consumers crave, and when done right, customer adoption, and brand experiences both skyrocket.

On the retention side, financial services can be one of the biggest drivers of customer loyalty and lifetime value that brands can offer.

Rewards tied to branded card spending are a well-known tactic for a brand to drive loyalty and customer spending in a particular direction, but there are other core financial tools that brands can offer their customers that increase loyalty and retention.

Revenue

It’s no secret that banks make money on the transactions their customers make every day. This is commonly referred to as interchange revenue. Interchange is a fee that is charged by the banks and networks that process transactions, and are the costs associated with accepting, processing, and authorizing card transactions.

Interchange has always been considered a fee to merchants, and is a necessary evil associated with accepting card charges. Embedded finance changes this.

Without going into too much detail, when a brand owns the financial service and issues a branded card, for example, they capture a portion of the interchange that was originally a fee and turns into revenue. The numbers around interchange revenue vary, but most brands that offer branded debit cards to their consumers can estimate $100-$200 per year per customer in interchange revenue.

Beyond card transactions, brands that use embedded financial services like remittances and global payments capture a portion of the transaction fee as well.

Data

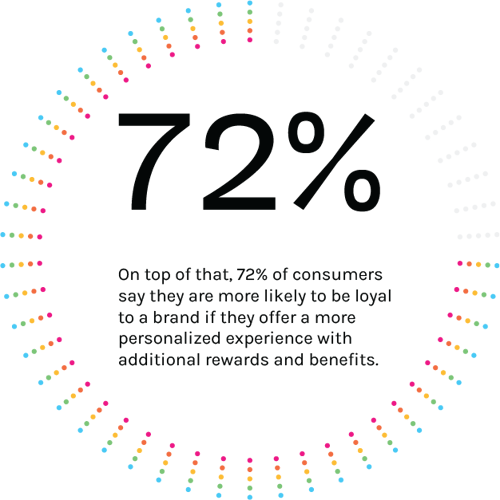

Data rules the world, and it's no secret that brands that capture more data on their customer's preferences and behavior create more opportunities for their customers to spend with them.

This is where embedded finance plays another huge role - transaction-level spending data. When a brand issues a debit, credit, or prepaid card, they directly capture the spending data from all customer's transactions.

While spending data adds a new layer of customer insights, the possibilities of layering it into a brand's business are seemingly endless.

Some of the ways that brands can use this data include cross-sell and up-sell opportunities, new partnership opportunities, new product ideas, philanthropic opportunities, and more.

When a brand embeds financial services, it has complete ownership of its customer spending data.

Core Products and Services

Embedded finance is not a one size fits all solution. The goal is always to create better customer experiences and reward your customers for continuously choosing you, but what products you use and how you choose to present them to your customers is up to you.

In most cases, regulatory requirements and complex financial technology make building financial services from scratch less efficient than working with a partner who has the foundations built and is an expert in the space.

It's important to think about your long-term program goals. For example, If you're looking to stand up a promotional card program to include in a marketing campaign, you'll want to start looking at particular features of that service that fits your business's needs.

If you're looking to implement a larger program that incorporates core banking services along with advanced features like dynamic rewards, cash back, and cross-selling opportunities, you'll want to start looking into full-scale embedded finance partners that have a variety of core financial products that will allow you to customize your offering to your customers.

At Alviere, we work with the world's top brands and enable them to use embedded financial services to do more for their customers. We work side-by-side with our clients from the ideation stage to find the right tools that will ensure they meet their goals and work together to deliver a best-in-class go-to-market strategy to ensure customer adoption and success. At the heart of every program are core financial services:

Bank Accounts & Digital Wallets

Many of the different financial services products you can offer your customers build off the foundation of accounts. There are three types of accounts that you can use within embedded banking - "For Benefit Of" (FBO) accounts, stored value accounts, and direct deposit accounts. Each type of account is used for different types of programs, and we work with our clients to decide which type of account(s) to use for their program(s). Click here to connect with an expert on which type of account to use for your program.

Accounts can be created with ease, and through our partnership with the industry-leading financial account connector, Plaid, customers can instantly transfer money to and from external bank accounts into the account they create with your brand. Customers can create both checking accounts and savings accounts.

Using digital wallets that are built into your existing app, or created as a new app, customers can make purchases, pay bills, transfer funds both locally and internationally 24/7, accept both electronic and cash load deposits and authorize P2P payments all in one place.

In addition, accounts come equipped with direct deposit capabilities that allow customers to deposit their salaries or receive ACH payments from external sources.

See more on Branded Bank Accounts.

Branded Card Issuing

Branded cards are one of the best ways to engage with your customers and become part of their daily lives. We enable you to create branded physical or virtual, debit, credit, or prepaid cards that put your brand at the forefront of your customers' daily spending.

Debit cards - Debit cards are at the foundation of consumer spending. By issuing your customers debit cards tied to their brand bank account, you capture a portion of the transaction revenue on every swipe or tap, along with all transactional data.

Credit cards - Credit cards are core to many consumers spending and can be tied to dynamic rewards programs. By issuing your customers credit cards, you can enable them to maintain strong credit or build credit, issue strong rewards programs tied to open-loop spending, and more. As the issuer of the card, you capture a portion of the transaction revenue on every swipe or tap, along with all transactional data.

Transaction revenue - commonly referred to as interchange revenue - can add up to $200/customer/year, and the spending data enables you to uncover insights about your customers that can lead to cross-selling/up-selling opportunities, new partnerships, new product development, and much more.

In addition, being the owner of the transaction data allows you to create dynamic rewards programs that your customers love.

See a reoccurring merchant in your within a particular customer segment? Create a rewards incentive at that merchant and encourage customers to use your card for spending at that merchant.

Want to support small businesses that complement the products and services you offer? Set up a rewards program that incentivizes your customers to spend at the group of small businesses you want to support.

Dynamic rewards create huge opportunities for customer engagement and reward your customers for spending with your brand, and not going into debt with your brand.

Prepaid Cards - offer your customers both open-loop and closed-loop prepaid cards. Open-loop allows your customers to use the card at any merchant, while closed-loop cards can only be used with merchant-specific retailers. Rules around accepted merchants are easily set in the Alviere portal.

Capture the same interchange revenue and customer insights you would use a debit card. Pre-paid promotional cards are commonly used for marketing campaigns to incentivize and attract new customers, amplify sales productivity, and better retain your existing customer base.

Branded card programs are extremely versatile and allow companies to get creative with marketing campaigns to acquire new customers, and keep existing. customers (and fans) engaged for longer.

The most common prepaid card programs you'll come across are the promotional cards that customers can get when they start service or open a new account (think telecommunications, security systems, etc.)

Card programs are also a great tool to engage existing customers. For example, a sports team can use limited branded prepaid cards to engage super fans with their favorite player featured on the card. Prepaid cards can also be reloadable, which gives fans the opportunity to use the card longer.

As the prepaid card space gets more creative, look out for creative card programs that keep the world's top brands, sports teams, bands, and influencers, engaged with new opportunities.

Global Payments

For people who have friends and family across borders, global payments are a normal part of life. The current way global payments are set up creates barriers and high fees that make moving money across borders challenging.

By using our global payments product you can offer your customers a low-cost, fast and easy way to send money around the globe. Cross-border remittances allow your customers to send money to 100+ countries with low change rates and quicker settlement times. They can also instantly convert payments into their local currency.

Cryptocurrency

Being there for customers for their future needs is a fundamental part of customer lifetime value. We enable you to do just that for your customers' cryptocurrency aspirations.

Buying or selling crypto can be a complicated process - by offering your customers crypto wallets in the same place they manage their branded bank account, you can give them a simple and effective way to buy/sell/store crypto.

Customers can easily convert crypto to fiat currency and avoid the price volatility of daily markets.

Payment Processing

The financial services that we have all become accustomed to today surround payment processing. Making purchases on a website or in-store requires a payment processing partner (or multiple).

Our payment processing system enables you to eliminate the need for a dedicated payment processor and utilize our technology for accepting payments and also processing your customers' money movement needs.

Real-time payment processing with POS integration allows you to instantly accept payments for immediate funds availability, instant confirmations, and precise settlement records that enhance your spending insights.

Use bank transfer processing for ACH & EFT payments, direct deposit processing, and cost-effective funds transfers that keep expenses low, and revenues high.

Provide your customers instant deposit and withdrawal to and from their brand bank account, and enable mobile check deposit and cash loading at over 20,000 ATMs.

See more on Payment Processing.

Security and Compliance

Security and compliance are at the foundation of all the products you see above.

AML Module & Monitoring is constantly running at all times to identify high-risk account activity with the highest security standards.

During new customer onboarding, KYC with identity verification is performed for effective customer segmentation and deeper insights into customer behavior. Similarly, if you are offering financial products to businesses, KYB monitoring is performed for verification of company registration, stakeholders, and business licensing compliance.

Beyond technology, you have an entire operational support team with a dedicated risk management team to detect, respond and eliminate fraud-related risks to minimize overall losses.

See more on Security and Compliance.

Customer Adoption Incentives

Once you've aligned your core products with your program goals, it's time to have fun with your program. As we mentioned above, using embedded financial technology enables your company to capture raw spending data from your customers' transactions.

Data ownership opens new doors to the ways you can engage your customers. Traditionally, rewards programs are run and controlled by the banks and network providers that companies partner with to launch co-branded card programs. Direct ownership of transaction data enables companies to run rewards programs their way and create comprehensive customer profiles that capture data on spending outside their stores.

Example: Using data points like merchant ID, companies can simply turn on a rewards program for any merchant they choose, set a time frame for the incentive, and launch the offer to their customers.

Adoption and Retention Features:

- Cashback at select merchants for all customers or sub-segments of customers

- Dynamic rewards points programs for all customers or sub-segments of customers

- In-app financial wellness scoring

- Referral programs

- High-yield savings on cash in an account

- Buying, selling, and holding equities and other financial assets in-app

- Holding branded NFTs in-app

Note: Carefully planned out incentives through advanced features are a critical component of customer adoption - make sure your technology partners have the capabilities to customize the offers you want to extend to your customers.

What's Next?

Now that you have the playbook to use embedded financial technology to enhance your core business, it's time to take the next step! If you're interested in learning more, contact us through the button below - let's talk embedded finance at your company!

We believe every business should have the power to do more for their customers. Our mission is to enable any business to use embedded financial services to increase revenue per customer, higher retention, and deeper customer relationships and insights through ready-made financial services provided as an all-in-one solution.

We are compliant to operate in over 100 countries, so your brand can offer financial services all over the world. We handle all the onboarding, customer support, fraud management, and risk compliances, so you can focus on your core business and launching financial services to your customers.