Onafriq launches remittances and payments from the U.S. to Africa

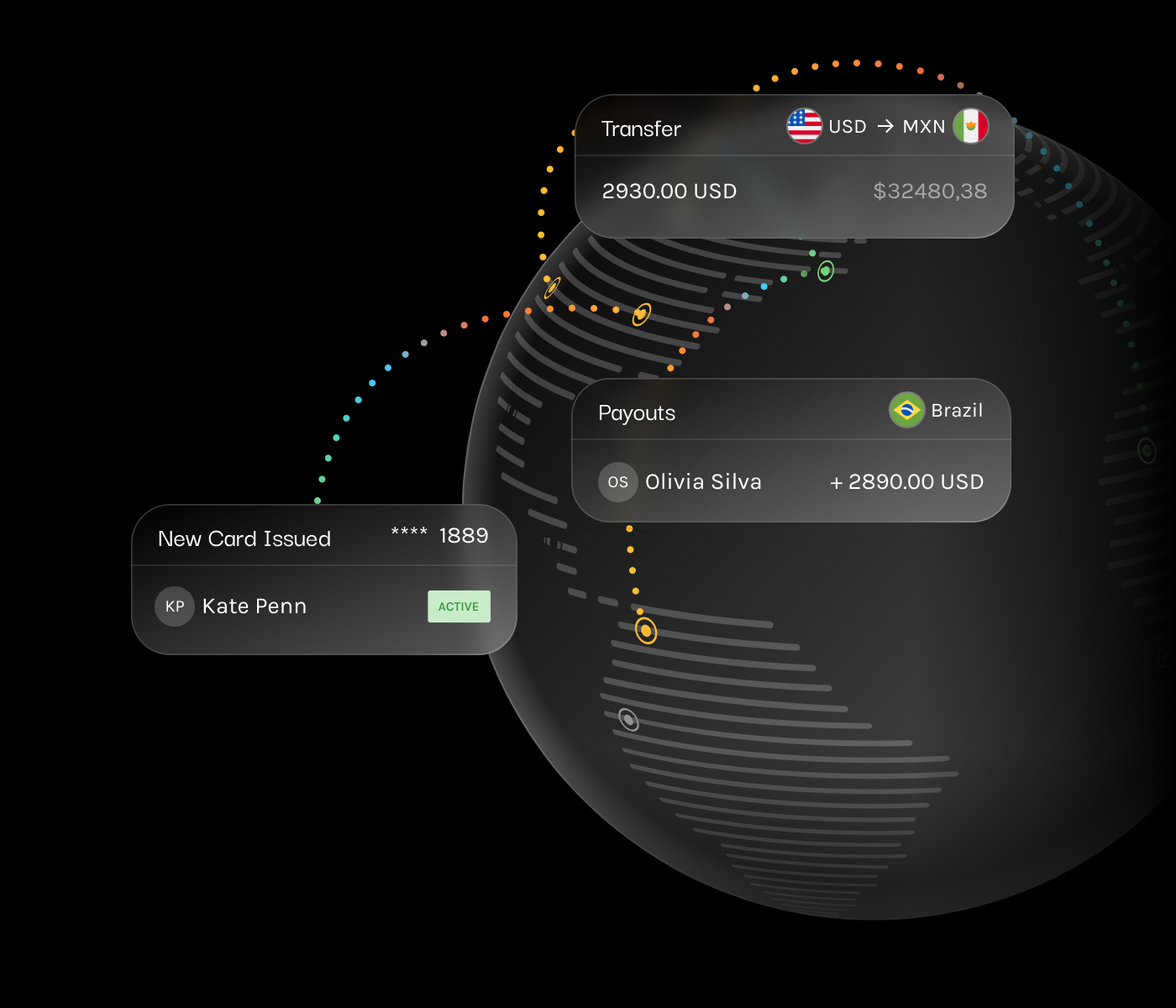

Africa’s largest digital payments network, Onafriq, connects more than 500 million mobile wallets, 200 million bank accounts, and 400 thousand small medium businesses across the continent. With Alviere, it leverages the Alviere HIVE platform and company’s regulatory framework to process payments originating from the U.S. in strict compliance with Anti-Money Laundering (AML) standards for U.S. financial institutions.