Drive in-store traffic

Offer cross-border remittances in physical stores to increase foot traffic and customer engagement. Offer cash loading, check cashing, and cash pickup via cashier or kiosk.

The National Retail Federation (NRF) says identifying new opportunities, redesigning physical stores to be more coordinated with shoppers’ desire for experiences alongside efficiency, and investing in tech projects that deliver personalization and optimization are key for 2024.

Here are three ways to innovate quickly.

Offer cross-border remittances in physical stores to increase foot traffic and customer engagement. Offer cash loading, check cashing, and cash pickup via cashier or kiosk.

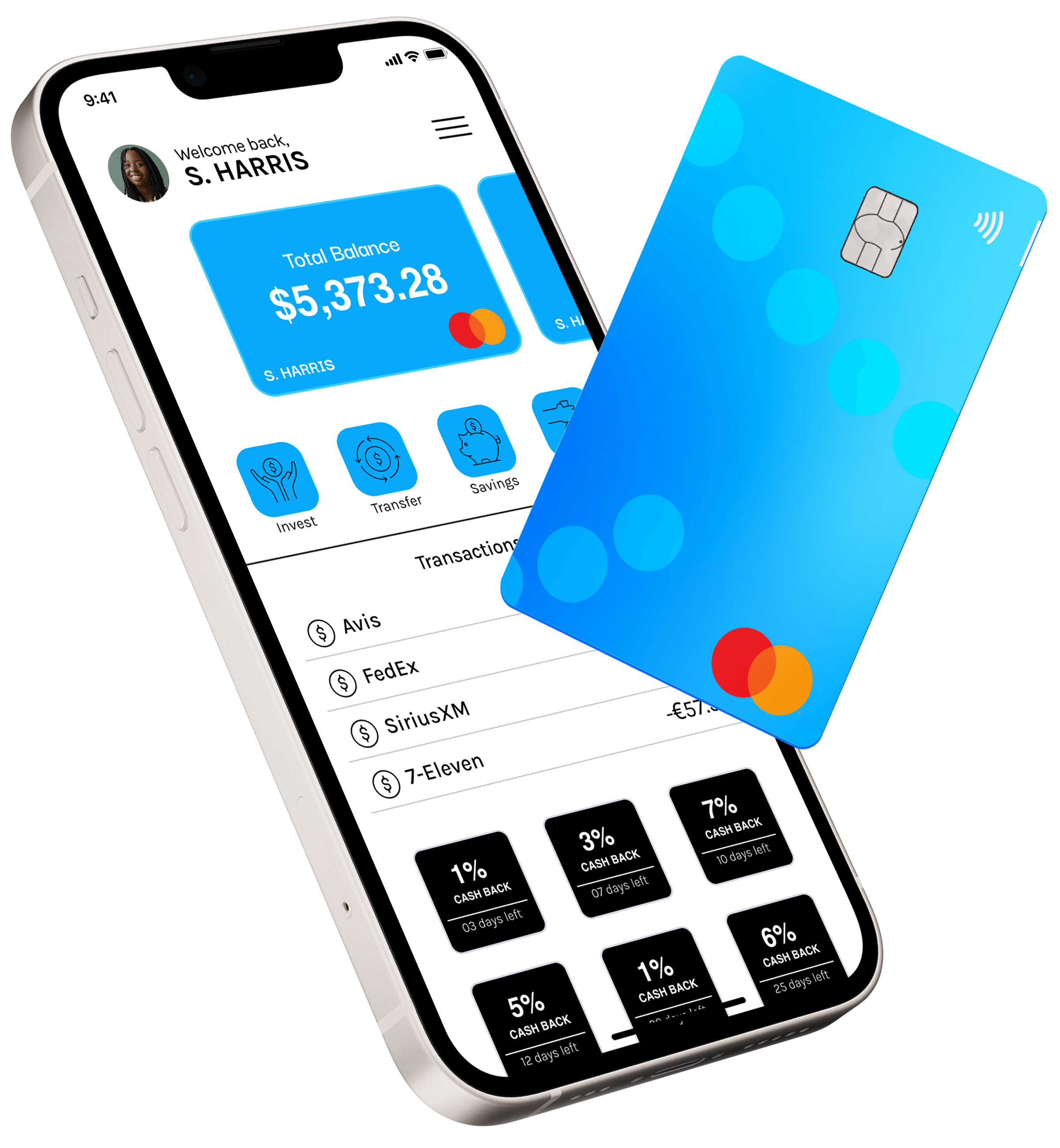

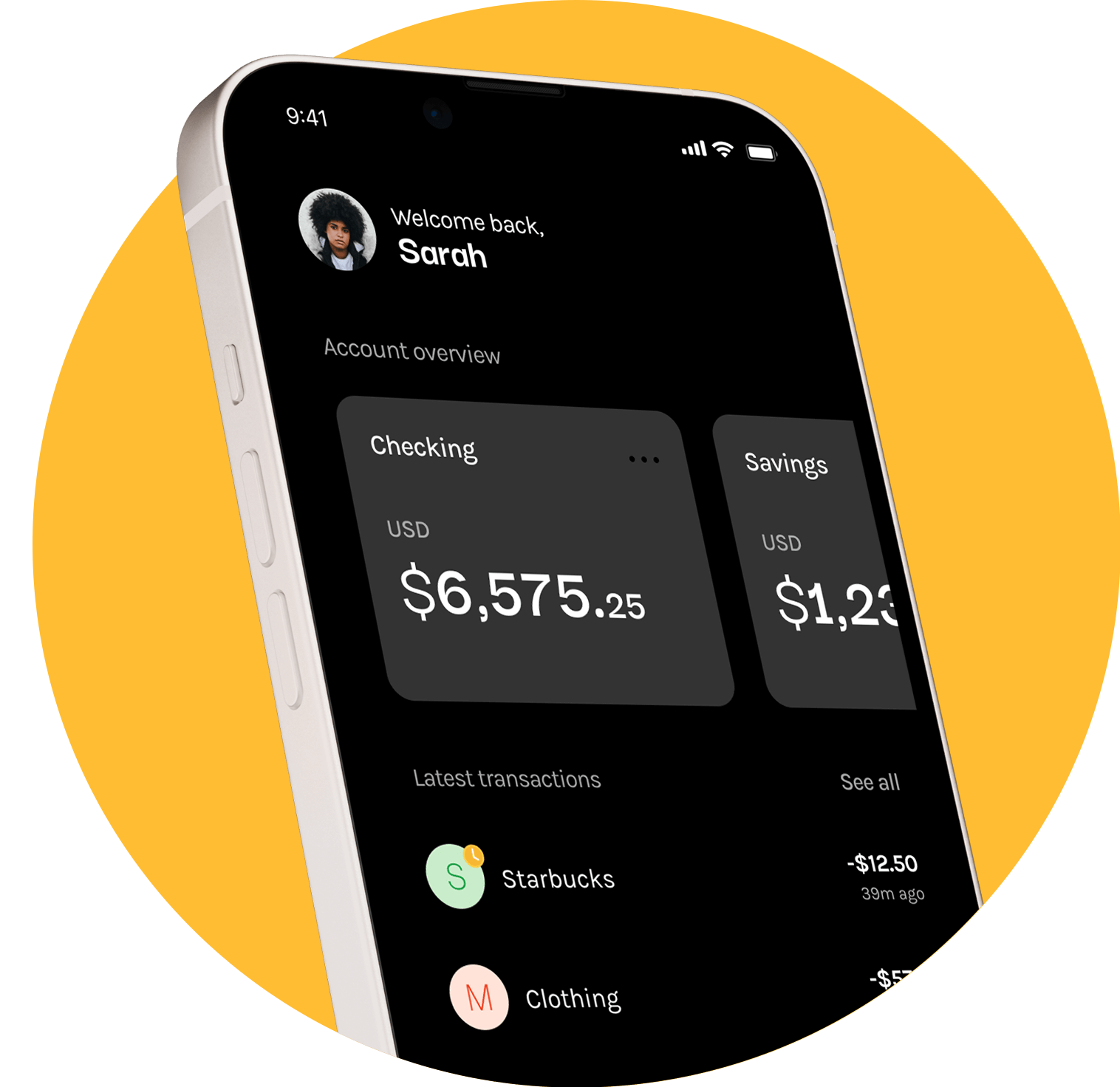

Add wallets and accounts to your existing app for more loyalty, the ability to pre-fund a consumer's next purchase, and cash out rewards. Own your brand experience.

Overcoming the "sea of sameness" in loyalty programs - Forbes

Many consumers don't qualify or don't want another credit card. Give them a branded debit card in your company name with open-loop spending capabilities. You get more engagement, and more loyal customers.

Offer financial accounts and USD digital wallets with banking functionality to help end-users manage, save, and spend flexibly, without leaving your app.

Issue virtual or physical prepaid, debit, or gift cards in your own brand. Open or closed loop cards for utmost flexibility.

Enable cross-border remittances for consumers, with cash loading across the U.S. and cash pickup available in more than 100 countries.

Alviere offers a single, integrated platform experience under one Master Services Agreement. There’s no need to identify outside service providers, vendors, or partners to launch a new financial program or feature. Rely on our experts to source the necessary technology and integrate it into the Alviere HIVE platform.

As a licensed entity, Alviere runs a safe and reliable operation that has been vetted and approved by regulators. Alviere built the HIVE platform to comply with all federal and state regulations, which helps safeguard enterprises embedding solutions that will reach the U.S. financial system.

Alviere adheres to strict Know Your Customer (KYC), Know Your Business (KYB), fraud management, and Anti-Money Laundering (AML) standards and processes. Our compliance team will determine what customer information you already have available, and any additional information or documentation necessary for identity verification. Our aim is to provide a smooth onboarding process for your end users while safeguarding your organization.

Before launch, Alviere implementation experts work with you to determine API integration, treasury management, and legal and regulatory considerations to meet Customer Identification Program (CIP) requirements. At the same time, a dedicated Customer Success manager supports your program with a consultative approach. Through launch, Alviere provides full white-label customer care. Or, we train and coach your Tier 1 support team.